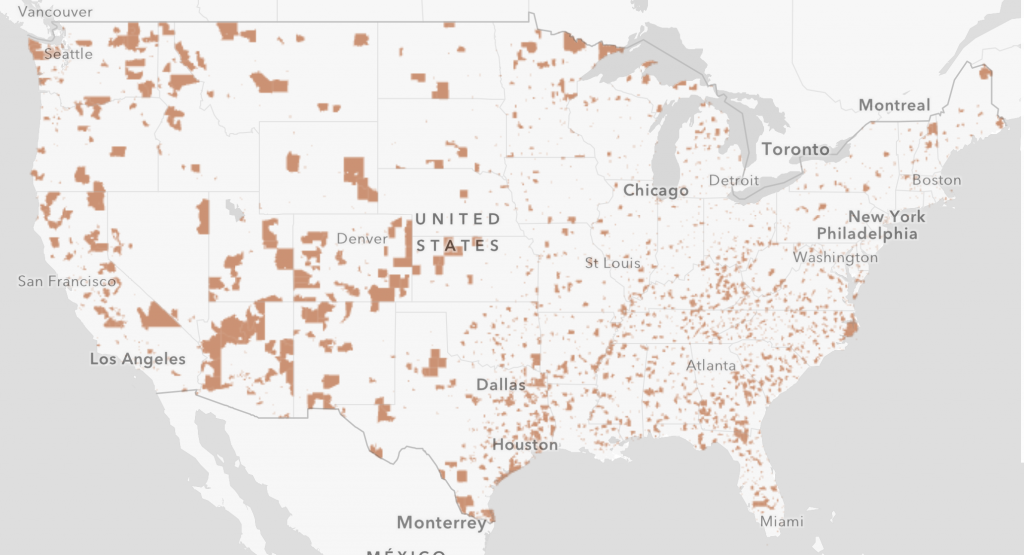

The government’s first public hearing on the popular tax incentive program drew concerns over refinancing those projects and for how long an Opportunity Zones asset can be held.

We woke reasonably late following the feast and free flowing wine the night before. After gathering ourselves and our packs, we headed down to our homestay family’s small dining room for breakfast, where we enjoyed scrambled eggs, toast, mekitsi (fried dough), local jam and peppermint tea.

We were making our way to the Rila Mountains, where we were visiting the Rila Monastery.

Developers and investors are enamored enough with the federal Opportunity Zones program that they have been raising massive funds in hopes of taking advantage of the big tax incentive. But they remain cautious enough over of the program’s many unanswered questions that few have deployed much of the capital raised.

Those dueling realities played out Thursday in Washington, D.C., when the IRS’ first public hearing to solicit questions about the year-old program drew an overflow crowd. About 200 people gathered in a small room, and a couple of dozen speakers aired their concerns, according to three people who attended the hearing. The hearing had been scheduled for January, but was delayed because of the 35-day partial government shutdown.

Steve Glickman, a co-founder of Economic Innovation Group, was one of those in attendance. Glickman is credited with helping craft the Opportunity Zones program, which provides tax deferments and tax breaks for developers who invest in projects in designated low-income neighborhoods across the country. Also at the hearing were Michael Novogradac, a CPA and managing partner at Novogradac & Company; and Jill Homan, an Opportunity Zones adviser, and fund manager.

One of the biggest questions asked, Glickman said, was about the amount of time that investment funds have to deploy capital raised for Opportunity Zones projects. Existing regulations give funds six months from the time the money is received. But many of the funds say they want to hold the cash for at least a year before deploying it.

Numerous Opportunity Zone funds targeting hundreds of millions of dollars have been launched in recent months, by firms including Youngwoo & Associates, Somera Road, Fundrise, RXR Realty, and EJF Capital. Skybridge Capital is targeting a $1 billion fund. That fund was rolled out in December with EJF as a subadviser, though SkyBridge later dissolved their partnership and found a new subadviser.

In October, the government released its first set of guidelines but left many topics unaddressed. It did specify that a business will qualify for the program if 70 percent of the company’s property is located within a designated zone.

The Opportunity Zones program pushed forward in President Trump’s 2017 tax overhaul plan gives investors and developers the ability to defer and potentially forgo paying some of their capital gains taxes if they hold the asset for at least five years. And the biggest gain comes after investors hold the asset for at least ten years. But real estate investors often buy and sell assets after only a few years.

Given that fact, could an investor sell an Opportunity Zone asset after three years, then reinvest the money into another Opportunity Zone project for seven years? Would the total 10-year hold period still qualify for the program?

Another question: How much capital can an investor or developer take out of a project when refinancing an Opportunity Zone property? And after the refinance, how will the proceeds of the refinancing be distributed to investors?

Asked, but not answered. IRS officials only listened. Investors and developers will be looking for those answers when the government releases its second round of rules, which is expected in the next two months.