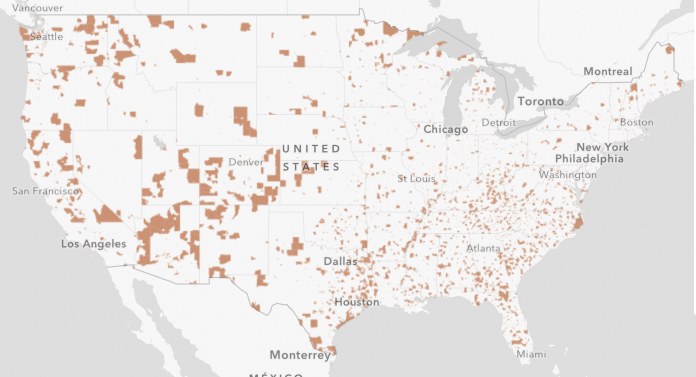

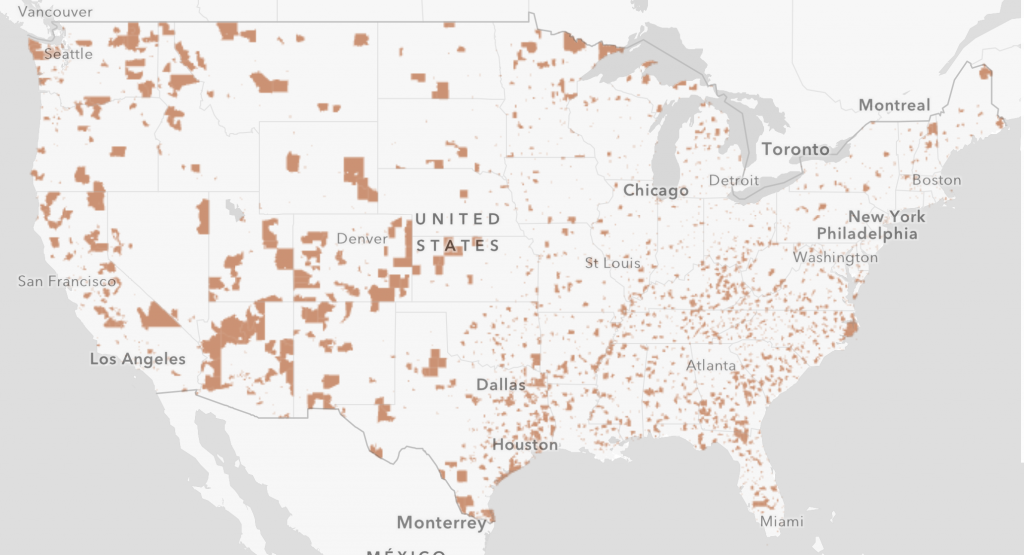

Opportunity zones have been a recurring topic in investment news lately, and for good reason. Created by the Tax Cuts and Jobs Act, new tax incentives now exist to stimulate investments in designated distressed areas known as Qualified Opportunity Zones (QOZ) throughout the United States and its possessions.

We woke reasonably late following the feast and free-flowing wine the night before. After gathering ourselves and our packs, we headed down to our homestay family’s small dining room for breakfast, where we enjoyed scrambled eggs, toast, mekitsi (fried dough), local jam and peppermint tea.

Opportunity zones: Tax incentives

Internal Revenue Code Sections 1400Z-1 and 1400Z-2 (and to date, two sets of clarifying proposed regulations) provide rules permitting taxpayers to defer recognition of capital gains from the sale of a property, in some cases permanently. To qualify for these incentives, you must invest cash from capital gains in a qualified opportunity fund (QOF), which is an investment vehicle organized as a corporation or partnership having the purpose of making qualified investments in a QOZ.

Gain deferral

If you are generating capital gains from the sale or exchange of property, you may elect to defer recognition of such gains and invest them in a QOF within 180 days of the sale or exchange. More lenient investment timing rules are available for capital gains flowing through Schedules K-1 related to partnership investments. This deferral opportunity applies to capital gains from sales or exchanges occurring on or before December 31, 2026. You may defer elected capital gains until the earlier of December 31, 2026, or the date of a partial or complete sale or exchange of a QOF investment.

Deferred gain exclusion

In addition to deferral, special-basis rules have the effect of permanently reducing the original deferred gain when your QOF investment meets specified holding periods:

- 10 percent gain exclusion – QOF investment held for a 5-year period ending on or before December 31, 2026.

- Additional 5 percent gain exclusion – QOF investment held for a 7-year period ending on or before December 31, 2026.

Post-QOF investment gain exclusion

If you hold a QOF investment at least 10 years, you are eligible for an additional tax incentive. By statute, your basis in a QOF investment increases to its full fair market value upon sale, which renders 100 percent of post-QOF investment appreciation tax-exempt. This exemption of post-QOF investment gain is the centerpiece of the tax incentive package offered in the opportunity zone provisions.

State jurisdictions have taken different tacks relative to the tax treatment of QOF investments, with some adopting the federal rules in full, and others decoupling from federal law. In some cases, states have rejected both the capital gain deferral provisions and post-appreciation gain exemptions.

Opportunity zones: Energy applications

Energy executives experiencing capital gains from monetization events may wish to consider taking advantage of these new QOZ tax incentives. An investment in a QOZ can be a tax-efficient way of realizing and enhancing investment returns, while at the same time achieving the government’s policy objective of providing relief to economically distressed areas.

For those familiar with like-kind exchanges, QOZ investments are in some ways more flexible than such exchanges in that sellers may receive sales proceeds directly, replacement assets do not need to be of like kind, and the deferral election for partnership gains is available at the partner level. On the other hand, QOZ investments require certain maintenance and compliance testing on an ongoing basis, which make them more administratively burdensome.

Many designated QOZs are located in energy-producing areas conducive to QOF investment projects. In the upstream space, the QOZ tax incentives may be available for acquisitions and development of leasehold interests. Acquisitions of undeveloped leasehold interests are generally easier to navigate than acquisitions of developed leasehold interests because of the potential for meeting the “original-use” requirement discussed below. Acquisitions of developed leasehold interests elicit larger challenges because they fail the “original-use” requirement, and therefore must be “substantially improved.” Questions exist as to the application of the original-use and substantial improvement rules to oil and gas leasehold interests, requiring analysis on a facts and circumstances basis. Midstream infrastructure build-outs and renewables projects may also be viable QOF investment candidates.

Opportunity zones: Requirements

QOFs must comply with a number of detailed rules prerequisite to your enjoyment of the above-described tax incentive benefits. These rules are designed to ensure elected capital gain dollars invested in QOFs accomplish the primary purposes of the opportunity zone legislation, which are to stimulate designated distressed areas through, among other things, new job creation and commercial activities, aesthetic upgrades, and incremental tax revenue sources. Following is a brief summary of the requirements:

- The QOF serving as the investment vehicle must be properly established, which is a relatively simple process.

- A QOF receiving investment dollars must put those dollars to use within 6 months, holding at least 90 percent of its assets in the form of QOZ property, which includes QOZ business property, QOZ corporation stock, and QOZ partnership interests.

- QOFs investing in QOZ business property must meet the following requirements:

- Property must be tangible property used in a trade or business.

- Property must be purchased from an unrelated party.

- The original use of the tangible property must begin with the QOF, or if not original use, the property must be “substantially improved” within 30 months of the acquisition of the property.

- QOF’s investing in QOZ corporate stock or QOZ partnership interests must meet the following requirements:

- Shares of stock or partnership interests must be acquired directly from the corporation or partnership solely for cash.

- The corporation or partnership must operate a QOZ business, passing:

- A test requiring at least 70 percent of all owned or leased tangible property be used in a QOZ.

- An income and assets test requiring:

- At least 50 percent of gross income be derived from the active conduct of a trade or business in the QOZ.

- A substantial portion of any intangible property be used in the active conduct of a trade or business in the QOZ.

- Less than 5 percent of the aggregate unadjusted bases of the property of the trade or business be attributable to portfolio assets.

Our energy team stands ready to help you assess QOZ incentive opportunities. Please contact us to discuss how we can help.